Financial wellbeing in the workplace

Helping your people build financial resilienceFinancial wellbeing strategies that inspire confidence within your people

For your people who may be struggling to manage their debt, their day-to-day finances, or even those planning for retirement in an ever-changing landscape, the stress and anxiety these events place on individuals can have an impact on their health, wellbeing, and performance. It’s therefore in your best interest as an employer to help your workforce, however you can, to achieve financial stability.

Claire Battersby

Senior employee benefits consultant QFA, APA, RPA

We’re here to help you implement a long-term financial wellbeing strategy that raises your peoples’ financial capability, offers accessible solutions, and adds real value to your business.

Your people may look to you for support through key life events

As an employer or HR team, you are uniquely positioned to deliver guidance. After all, you are often engaged with many of your peoples’ key life events, including starting work, becoming parents, and retiring. As such, you are well placed to offer guidance and timely signposting to the people you are there to support.

A lack of financial resilience can lead to:

- A reduction in your peoples’ health and wellbeing

- An inability for your people to save for life’s important milestones

- Your people being distracted and unable to bring their best selves to work

- Higher levels of stress-related absence among your employees

The value of boosting your peoples’ financial resilience

Supporting the financial wellbeing of your people can help improve the overall wellness of your workforce, help people build financial resilience, and help them live the life they want. Ultimately, this is beyond demonstrating a duty of care; it can enhance your Employee Value Proposition (EVP) and business performance.

Offering financial wellbeing support to your people can help to:

- Improve your EVP, demonstrate your duty of care, and encourage talent retention

- Reduce finance-related stress among your employees

- Empower your people to perform at their best

- Minimise stress-related absence and increase productivity

Designed with your employee benefits in mind

Our workplace financial wellbeing strategy will be designed with your employee benefits programme in mind, to provide a solution specific to a financial stress point. With a trusted solution, it will make it more likely your people will act to improve their financial wellbeing.

Should we highlight any areas where your employee benefits programme doesn’t offer a tangible solution or product, we’re able to review and propose several provider solutions that you may wish to consider.

Educational modules

Education delivered at a time to suit your people

We can deliver sessions for your people via interactive webinars or in person, and at a time to suit your business and your people’s busy lives. We can also visit your business to run one-to-

one clinics or more informal drop-in sessions, where your people can pop in and have a chat in a more relaxed environment.

- In-person group sessions

- Interactive webinars

- Drop-in sessions for individuals

- One-to-one clinics

Giving your people access to trusted advice

With the service often called wealth management, many people feel like this support is reserved for those with certain amounts of money - but this isn’t the case. Our financial planning team can support all your people that are facing important, complex financial decisions. Whether it's preparing for retirement, protecting a young family or a one-off situation that requires specialist help, we can help them with key areas in their lives such as:

Request a call back from one of our employee benefits consultants

To discuss your requirements, fill out the form below and we will be in touch.

We can also support you with…

Workplace pension

Helping your business navigate safely around pension legislation.

Consulting and broking

Creating and delivering long-term employee benefits strategies.

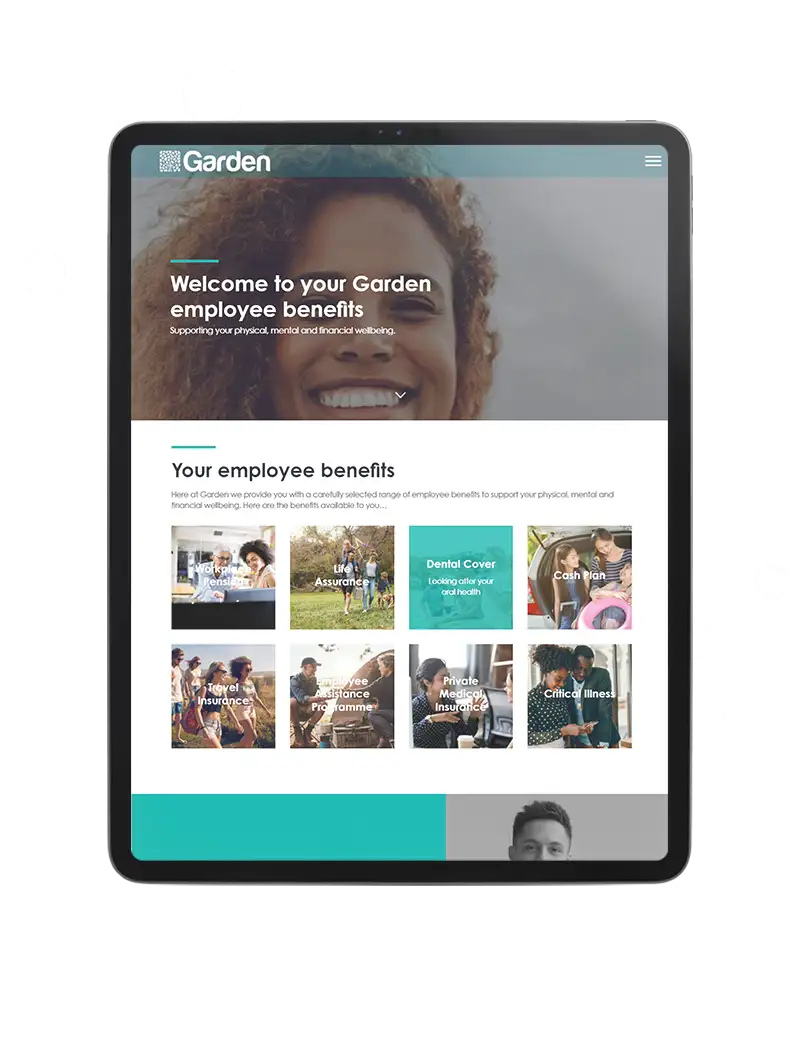

Member engagement

Helping your people get the most out of their emloyee benefits.